DB Function in Excel

In this post, you will be guided through simple and easy to follow steps on how to use the DB function in Excel.

Microsoft Office Excel provides the DB function, which returns the depreciation of an asset for a specified period using the fixed-declining balance method for each period of the asset’s lifetime.

Table of Contents

DB Function in Excel

The DB function in excel calculates the depreciation of an asset, using the Fixed Declining Balance Method, for each period of the asset’s lifetime. It is a built – in Excel function under the category Financial Functions.

DB Function Syntax

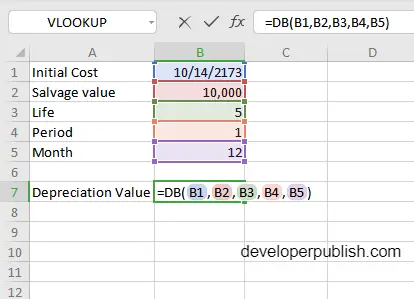

= DB(cost, salvage, life, period, [month])

The DB function and arguments

- cost (required)– Initial cost of asset.

- salvage (required) – Asset value at the end of the depreciation.

- life (required) – Periods over which asset is depreciated.

- period (required) – Period to calculation depreciation for.

- month (optional) – Number of months in the first year. Defaults to 12

How to use DB function in Excel?

- Open Microsoft excel and launch a workbook or create a new Excel sheet.

- As said in the description, you need the values of all the above arguments to carry out the DB function and get the correct and desired Depreciation value.

- Enter the arguments in the same order of the syntax, one below the other, as shown in the picture below.

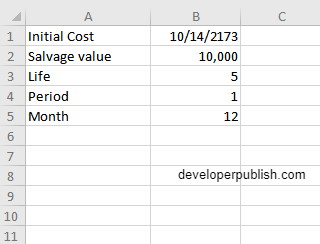

- At this time, in a similar way enter the values of each of the arguments in their corresponding adjacent cells in the worksheet.

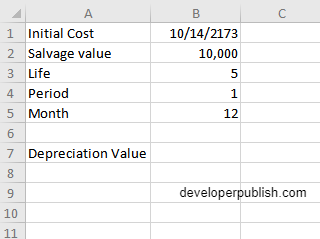

- Below the tabulated list of arguments, select a cell and enter “Depreciation value”, the cell to the right will display the value of the formula (making identification easier).

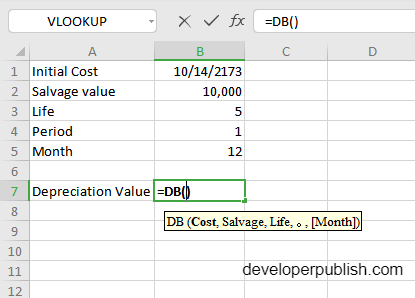

- When entering the formula, always start with the “=” operator. After entering the “=” operator enter DB to initiate the formula followed by an open parenthesis. Excel recognizes “=’ as the start of a formula, if not included, excel will not accept and evade the execution of the function.

- With the parenthesis open, select the arguments in the order of syntax. The position of the cell will be visible in the formula. According to the order of the syntax, the value of the argument must be selected followed by a comma. The change in color of the cells aids to identify the name and of the cells in the formula.

- To conclude, close the parentheses and click enter. The cell which contains the formula will display the Depreciation value.

Additional Formulas

- TO CALCULATE DEPRECIATION IN EACH YEAR

=(cost-prior depreciation)*rate

where,

rate = 1 – ((salvage / cost) ^ (1 / life))

DIFFERENT FORMULAS ARE USED FOR FIRST AND LAST PERIODS.

2. For the first period,

= cost * rate * month / 12

3. For the last period,

= ((cost - total depreciation from prior periods) * rate * (12 - month)) / 12

Leave a Review