Rectifying errors in your credit report is crucial for maintaining financial health and ensuring you get access to credit facilities at the best possible terms. In India, credit reports are issued by four major credit bureaus: CIBIL, Experian, Equifax, and CRIF High Mark. An error in your credit report can affect your credit score adversely, making it harder or more expensive to borrow money. Here’s a step-by-step guide to rectify errors in your credit report in India:

Step 1: Obtain Your Credit Report

First, obtain a copy of your credit report from the credit bureaus. As per the Reserve Bank of India (RBI) guidelines, you are entitled to one free credit report from each credit bureau every year. You can request your report by visiting the official websites of the credit bureaus.

Step 2: Review Your Credit Report

Carefully review your credit report for any inaccuracies. Common errors include incorrect personal information, misreported account statuses, duplicated accounts, and erroneous entries related to loan or credit card payments.

Step 3: Identify the Errors

Make a list of all the errors you find in your credit report. Ensure you clearly understand why each entry is a mistake by verifying it against your own records.

Step 4: File a Dispute

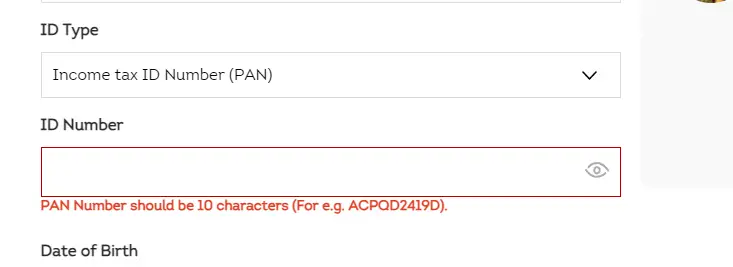

If you find errors, file a dispute with the respective credit bureau. Each bureau has its own process for filing disputes, which is typically outlined on their website. You can file a dispute online or by sending a written complaint. Include all necessary documents that support your claim, such as bank statements, loan documents, or identity proofs.

Step 5: Follow Up

After filing the dispute, the credit bureau will investigate your claim, which may take up to 30-45 days. They will check the disputed information with the respective lender or financial institution.

Step 6: Check the Resolution

Once the investigation is complete, the credit bureau will inform you of the outcome. If your dispute is valid, the errors will be corrected, and you will receive an updated credit report free of charge. Ensure the corrections are made by obtaining another copy of your credit report.

Step 7: Dispute with the Lender

If the credit bureau’s investigation does not resolve your dispute, you may need to contact the lender directly who reported the erroneous information. Provide them with evidence of the error and request them to correct the information with the credit bureau.

Additional Tips

- Keep Records: Maintain records of all communications with the credit bureaus and lenders, including emails, letters, and details of phone conversations.

- Know Your Rights: Familiarize yourself with the Credit Information Companies (Regulation) Act, 2005, which governs credit information companies in India and your rights as a consumer.

- Regular Monitoring: Regularly monitor your credit report to catch any future inaccuracies early.

Rectifying errors in your credit report can be time-consuming, but it’s essential for ensuring your financial health. Stay proactive about monitoring your credit information and act swiftly if you spot discrepancies to maintain an accurate and healthy credit profile.