In the realm of finance, your creditworthiness is often encapsulated in a three-digit number known as the CIBIL score. Developed by the Credit Information Bureau (India) Limited (CIBIL), now known as TransUnion CIBIL, this score has become a crucial metric for lenders assessing loan and credit card applications. This blog post delves into what a CIBIL score is, its importance, how it’s calculated, and how you can improve or maintain a high score.

What is CIBIL Score?

A CIBIL score, ranging from 300 to 900, is a numerical representation of your credit history and creditworthiness. It’s derived from your credit report, which is a detailed record of your loans, credit cards, and other financial behaviors. A higher score indicates better creditworthiness, suggesting to lenders that you’re a lower-risk borrower.

Importance of CIBIL Score

Your CIBIL score plays a pivotal role in your financial life, influencing:

- Loan and Credit Card Approvals: Lenders and credit card issuers heavily rely on your CIBIL score to make decisions. A high score can increase your chances of approval.

- Interest Rates: Often, the interest rates offered on loans or credit cards are contingent upon your credit score. A higher score may qualify you for lower rates.

- Credit Limits: Your score can also affect the credit limit on your credit card. A good credit score might lead to a higher limit.

- Loan Terms: Terms and conditions of loans, including duration and collateral requirements, can be more favorable with a high CIBIL score.

How is CIBIL Score Calculated?

TransUnion CIBIL calculates your credit score based on several factors from your credit report, including:

- Payment History (35%): Timely payments on credit cards and loans significantly impact your score.

- Credit Utilization Ratio (30%): This is the ratio of your current credit card balances to your credit limits. Lower utilization rates are viewed favorably.

- Length of Credit History (15%): A longer credit history provides more data for scoring, generally benefiting the score.

- Credit Mix and New Credit (20%): Having a mix of credit types (home loan, car loan, credit cards) and how often you apply for new credit influence your score.

Tips to Improve Your CIBIL Score

Improving your CIBIL score is a process that requires disciplined financial behavior. Here are some tips:

- Pay Your Dues on Time: Ensure that you pay all your credit card bills and EMIs on or before the due date.

- Maintain Low Credit Utilization: Try to keep your credit utilization ratio under 30%.

- Avoid Multiple Credit Applications: Applying for several credit lines in a short period can negatively impact your score.

- Monitor Your Credit Report: Regularly review your credit report for inaccuracies and dispute any errors you find.

- Use a Mix of Credit: A healthy balance between secured (e.g., home loan) and unsecured (e.g., credit card) loans can positively affect your score.

How to Check Your CIBIL Score?

Checking your CIBIL score online is a straightforward process that can give you insight into your creditworthiness, which is crucial when applying for loans or credit cards. Here’s a step-by-step guide to checking your CIBIL score online:

Step 1: Visit the Official CIBIL Website

Start by visiting the official TransUnion CIBIL website (www.cibil.com). This site is the only place where you can get your authentic CIBIL score and report.

Step 2: Create Your Account

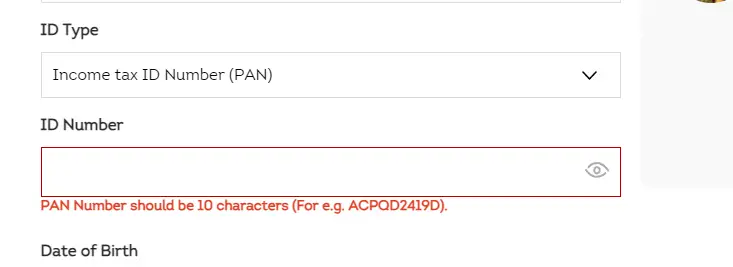

If it’s your first time, you’ll need to create an account. Click on the “Get Your CIBIL Score” or similar option. You’ll be asked to provide personal details such as your name, email address, ID proof (like PAN, Aadhaar, etc.), and date of birth. Ensure that the information you provide matches the details in your financial records to avoid discrepancies.

Step 3: Verify Your Identity

As part of the registration process, you’ll be required to answer a few questions to verify your identity. These questions may relate to your past loans or credit cards and are pulled from your financial history to ensure security.

Step 4: Access Your CIBIL Score and Report

Once your identity is verified, you may be given options to subscribe to CIBIL services or to access a free report. As per RBI guidelines, you are entitled to one free credit report from CIBIL every year. Choose the appropriate option to proceed. If you’re accessing your free annual report, select that option. For continuous access, you may consider subscribing to their paid services.

Step 5: View Your CIBIL Score and Report

After completing the above steps, you’ll be able to view your CIBIL score and detailed credit report. The report includes your credit score, credit history, loan and credit card accounts, outstanding balances, and a record of all your credit-related activities.

Understanding Your CIBIL Score

- 300 to 549: Poor credit score, may result in loan/credit card application rejections.

- 550 to 699: Fair score, but you might get loans at higher interest rates.

- 700 to 749: Good score, indicates responsible credit behavior and good chances of loan approval.

- 750 to 900: Excellent score, qualifies you for the best interest rates and credit terms.