Your CIBIL score is a critical factor that lenders consider when evaluating your loan or credit card applications. It’s a numerical representation of your creditworthiness, based on your credit history and financial behavior. Fortunately, checking your CIBIL score has become easier than ever, especially with tools like your PAN card. This blog post will guide you through the process of checking your CIBIL score online using your PAN card.

Understanding the Importance of Your PAN Card in Checking CIBIL Score

The Permanent Account Number (PAN) card serves as a unique identifier for Indian taxpayers, making it an essential document for various financial transactions, including checking your CIBIL score. Since your PAN is linked to all your financial activities, it allows CIBIL to accurately retrieve your credit information and generate your credit score.

Step 1: Visit the Official CIBIL Website

Begin by navigating to the official TransUnion CIBIL website (www.cibil.com). This site is the legitimate source for obtaining your CIBIL score and credit report.

Step 2: Find the CIBIL Score Check Option

On the CIBIL homepage, look for the option to check your CIBIL score. It might be labeled something like “Get Your CIBIL Score” or “Check Your Credit Score.” Clicking on this option will direct you to the page where you can initiate the process.

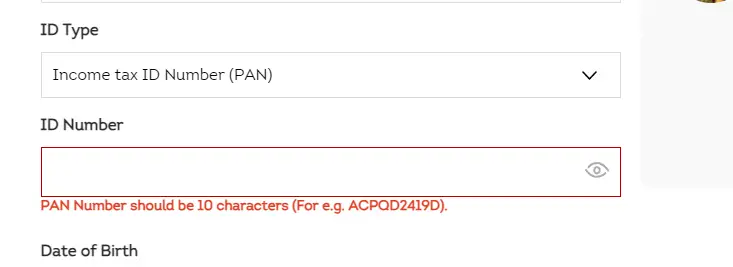

Step 3: Fill in Your Personal Details

You will be prompted to fill out a form with your personal information. Here, you’ll enter details such as your name, date of birth, and gender. Most importantly, you’ll need to provide your PAN number. Ensure that the information you enter matches the details on your PAN card and other financial documents to avoid any discrepancies.

Step 4: Verify Your Identity

To ensure the security of your financial information, CIBIL requires you to verify your identity. This step might involve answering a few questions related to your credit history, such as details of previous loans or credit cards. This process is crucial for preventing unauthorized access to your credit report.

Step 5: Choose Your Subscription

CIBIL offers different options for accessing your credit score and report. You can opt for a one-time report or subscribe to a plan for regular updates. As per the Reserve Bank of India (RBI) guidelines, you’re entitled to one free credit report from CIBIL every year. Select the option that best suits your needs.

Step 6: Access Your CIBIL Score and Report

After completing the verification process and selecting your subscription, you’ll gain access to your CIBIL score and detailed credit report. This report provides a comprehensive overview of your credit history, including loan and credit card accounts, outstanding balances, and payment history.

Understanding Your Score

- Below 600: Indicates poor credit health, making it challenging to obtain loans or credit cards.

- 600-749: Represents fair to good credit, but there’s room for improvement to secure better interest rates.

- 750 and above: Signifies excellent credit health, offering you the best chances for loan approval at competitive rates.

Tips for a Smooth Process

- Ensure Accuracy: Double-check the details you enter, especially your PAN number, to avoid errors that could delay the process.

- Regular Monitoring: Keeping an eye on your CIBIL score helps you understand your financial standing and take steps to improve if necessary.

- Rectify Discrepancies: If you spot any inaccuracies in your credit report, report them to CIBIL immediately for correction.

Conclusion

Checking your CIBIL score using your PAN card is a simple and efficient process. By regularly monitoring your credit health, you can take proactive steps to maintain or improve your score, thereby enhancing your eligibility for loans and credit cards. Remember, a good CIBIL score opens the door to better financial opportunities, so it’s worth keeping it in check.